What Is IR35?

IR35 is the short name used for the ‘intermediaries legislation’, introduced in 2000 aimed at countering tax avoidance, specifically aimed at the limited company contractors that organisations hire.

Genuine limited company contractors are small businesses who pay tax differently to permanent employees. They do not receive any kind of job security or the employment rights and protections that employees enjoy. But contractors choose to work that way because of the benefits they enjoy from being their own boss.

IR35 is designed to combat ‘disguised employees’ - which HMRC believes would be employees of the client if they didn’t work through an intermediary, such as a limited company.

The taxman argues that someone performing the same role as an employee should be taxed as an employee, even though IR35 is actually concerned with the nature of the working relationship between the hirer and worker.

What are the public sector off-payroll IR35 reforms?

Prior to April 2017, contractors have been responsible for determining their own IR35 status. And their limited companies have been liable for any unpaid taxes and penalties if HMRC investigated and decided that the legislation applied. But, from 6 April 2017 in the public sector, the compliance burden and potential liability for unpaid tax shifts further up the supply chain.

The key changes introduced in the public sector are:

- Contractor’s end clients, are responsible for determining the contractor’s IR35 status.

- Recruitment agencies must calculate, report and process tax at source via Pay As You Earn (PAYE) on each payment made to a contractor who is caught by IR35.

- If there is no agency, responsibility for processing the tax rests with the hirer.

- The agency is liable for tax if an incorrect IR35 judgement is made.

- The hirer must take reasonable care when assessing contractors else be vulnerable to extra cost.

The reforms generate many challenges for the public sector. Being able to compliantly keep hold of contractors without incurring significant administrative and financial costs is essential.

Public sector IR35 guide - FREE download

IR35 changes in the public sector generate significant risks to you. Use this guide to understand the changes, and find out what you can do to keep hold of your contractors, control costs and mitigate tax risk.

IR35Shield.co.uk - the ultimate assurance solution

IR35Shield.co.uk is an alternative, automated compliance solution that assesses the IR35 status, and helps keep them outside IR35.

The assessment takes only 15 minutes. Contractors can buy a detailed analysis Report used to help support evidence to HMRC that reasonable care has been taken in determining status.

It is underpinned by decades of IR35 experience and employment case law, and underwritten by insurers. Based on the Report, the entire tax liability can be insured by contractor, agency or client, offering the ultimate protection.

For more information visit IR35Shield.co.uk or simply Take The Assessment

IR35 Tax Calculator - calculate the cost of being caught by IR35

If IR35 applies to a contractor then they have to pay tax as if they were employed directly, including employers and employees National Insurance Contributions. But they will not get any employment rights. Because of this they may ask for an increased rate rise. Use the calculator below to explore the impact.

Guides on the IR35 Reforms

How to deal with the reforms

IR35Shield.co.uk vs HMRC CEST tool: How our tool can help everyone beat IR35

Keeping contractors outside IR35 is key to keeping their skills in the public sector. Find out how you can do exactly that with our IR35 shield tool.

Public sector contractors: 6 step plan to carry on working outside IR35

Follow this 6 step action plan to keep you operating outside IR35 by mitigating the impact of the public sector reforms.

Public sector contractors – 11 ways to commit IR35 suicide

Here are 11 things you must avoid if you want to stay outside IR35. Whatever you do, don’t ignore them!

How public sector organisations need to prepare for the IR35 reforms – right now!

Use our expert five step action plan to retain skilled resources, cut costs and keep compliant with the public sector IR35 reforms.

Agencies can override incorrect Off-Payroll (IR35) status decisions by clients

The Off-Payroll legislation shows that agencies are free to override assessments made by clients, as Matt Boddington of Chartergates explains.

How to appeal wrongful tax treatment following an incorrect Off-Payroll assessment

Tax expert David Kirk explains the various options available to contractors seeking to reclaim tax that has been overpaid as a result of Off-Payroll.

10 key failings of HMRC's IR35 testing tool CEST - 18 month investigation

An 18-month investigation by ContractorCalculator has uncovered numerous shortcomings and inconsistencies, proving that CEST is not fit for purpose

Latest news on public sector reforms

NHS Digital hit with £4.3m tax bill after reliance on faulty CEST

NHS Digital has been hit with a £4.3m tax bill after HMRC challenged a number of status assessments carried out using its own tool.

Others | Tuesday 29 October 2019

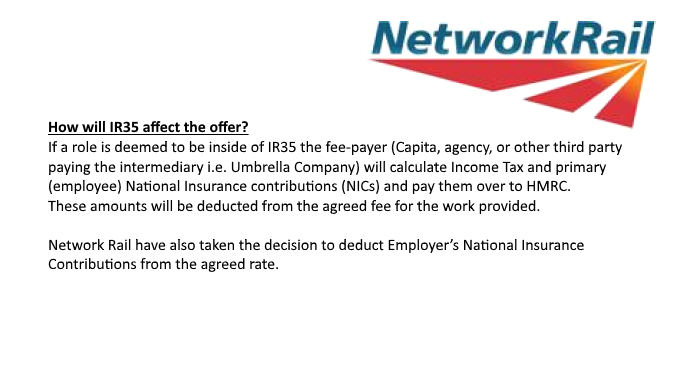

Network Rail accused of unlawful employer’s NI deductions under Off-Payroll rules

Network Rail has come under scrutiny after a document emerged suggesting it may have made unlawful employer’s NI deductions from contractor fees.

Others | Tuesday 4 June 2019

CEST caused 98% and 87% ‘deemed employee’ rates at Met Office and CCS, FOIs reveal

FOIs reveal more absurdly high ‘deemed employee’ rates produced by CEST for contractors assessed by both the Met Office and Crown Commercial Service.

Others | Monday 13 May 2019

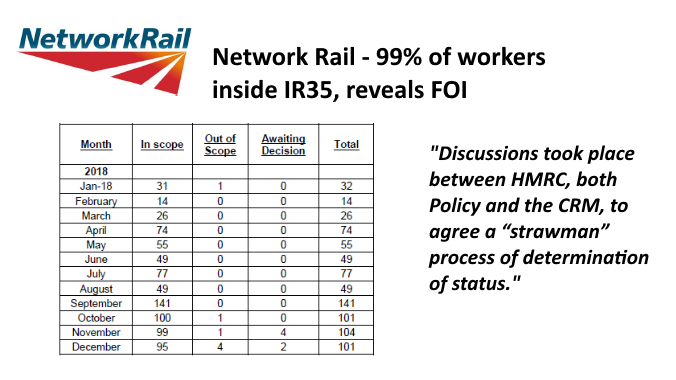

Unlawful Network Rail blanket approach finds 99% of workers inside IR35, reveals FOI

99% of Network Rail contractors have been deemed caught by the Off-Payroll rules as a result of unlawful blanket assessments encouraged by HMRC.

Others | Wednesday 1 May 2019

CEST users feedback, obtained via FOI, reveals little confidence in tool

User feedback for CEST, obtained by ContractorCalculator via FOI, reveals that, despite HMRC’s claims, there is little public confidence in the tool.

Others | Tuesday 19 March 2019

HMRC defends CEST and blames BBC over presenters fiasco in PAC hearing

HMRC tells MPs in Public Accounts Committee hearing that CEST was not at fault for hundreds of retrospective tax bills issued to BBC freelancers.

Others | Tuesday 5 March 2019

BBC pay: 20 key questions the PAC must ask HMRC about Off-Payroll and CEST

The PAC has an opportunity to hold HMRC to account for its application of CEST and the Off-Payroll rules. Here are 20 questions that need to be asked.

Others | Monday 4 March 2019

HMRC’s CEST further undermined following Naryan tribunal ruling citing lack of MOO

HMRC’s CEST tool is further discredited as judge rules controlled doctor Naryan was no employee because no mutuality of obligation (MOO) existed.

Others | Monday 4 March 2019

HMRC unable to substantiate allegations of misrepresentation against contractor press

HMRC has failed to substantiate allegations made during a recent IR35 Forum meeting of misrepresentation against the contractor press.

Others | Wednesday 27 February 2019

BBC refutes Treasury claim it was satisfied CEST was accurate

BBC has shared fresh evidence documenting its implementation of the Off-Payroll regime, quashing Treasury claims that it was satisfied with CEST’s accuracy.

Others | Friday 8 February 2019