Network Rail’s Off-Payroll compliance practices have come under further scrutiny after a document emerged suggesting that the public body may have made unlawful employer’s National Insurance (NI) deductions from fees paid to contractors.

An ‘IR35 factsheet’ was shared with ContractorCalculator by two separate contractors who were once negotiating contracts with Network Rail – one in April 2017, the other in September 2018. The contractors claim the document was distributed to candidates by Network Rail and recruitment company Capita to inform them of the impact of the Off-Payroll reform on their engagement.

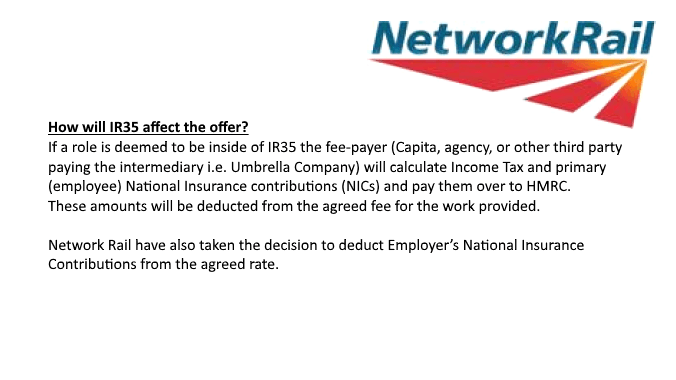

The document instructed candidates that, if deemed within scope of the rules, their fee would be subject to employer’s NI deductions. Responding to a Freedom of Information (FOI) request from ContractorCalculator, Network Rail disclosed numerous documents pertaining to its Off-Payroll compliance practices, yet the IR35 factsheet wasn’t included.

“This document describes the unlawful approach to Off-Payroll that we’re hearing is rife within the public sector,” comments ContractorCalculator CEO Dave Chaplin. “How Government can even consider a private sector extension when public bodies are issuing guidance suggesting that they are taking such an approach is unbelievable.”

Network Rail ‘factsheet’ indicates unlawful conduct

Under a subhead titled ‘How will IR35 affect the offer?’, the factsheet informs contractors: ‘If a role is deemed to be inside of IR35, the fee-payer will calculate Income Tax and primary (employee) National Insurance Contributions (NICs) and pay them over to HMRC. These amounts will be deducted from the agreed fee for the work provided. Network Rail have also taken the decision to deduct employer’s NICs from the agreed rate.’

This is contrary to the Off-Payroll legislation – ITEPA, Part 2, Chapter 10 - which requires that employer’s NI and the Apprenticeship Levy be paid on top of the agreed rate by the fee-payer.

Section 7 of HMRC’s guidance on applying the Off-Payroll rules offers further clarity on the matter, stating: ‘They [the fee-payer] cannot lawfully deduct the secondary NICs from a fee that has been agreed, but could, depending on the contractual terms, negotiate a lower fee.’

Contractor evidence belies Network Rail comments

Responding to ContractorCalculator, Network Rail acknowledged the factsheet. The public body claimed that the document was updated last year as it didn’t accurately reflect the reality of how contractor pay rates are calculated, adding:

‘Network Rail ensures it is compliant with all aspects of the law when applying IR35 determinations, including any subsequent fee calculation and payment, and communications to fee-payers.’

As Chaplin notes, this statement is inconsistent with other evidence that ContractorCalculator’s investigation has brought to light:

“Contractors have not only shared with us the ‘factsheet’, but also email exchanges between themselves and Capita, in which the recruiter informed them that their pre-agreed rate would be subject to employer’s NI deductions. This suggests that Network Rail had been unlawfully deducting employment taxes from contractor rates from April 2017 to September 2018 at the very least.”

He adds: “Until evidence emerges proving that this is no longer the case, and we hear from the contractors that the rules are being applied correctly, we have little reason to trust Network Rail’s claims.”

ContractorCalculator has shared with Network Rail proof of such evidence. However, at the time of writing, Network Rail is yet to issue a response. Capita has also declined to comment.

Can Network Rail’s compliance claims be trusted?

The news comes less than a month after it was revealed that an unlawful blanket approach to assessments led to Network Rail deeming 99% of its workers caught by IR35.

In response to a separate FOI request from ContractorCalculator, the public body disclosed details of a ‘strawman’ assessment process, agreed upon following consultation with HMRC. Here, generic roles would be assessed using the taxman’s Check Employment Status for Tax (CEST) tool, with its status determination applied to the workers undertaking the jobs.

After the story broke, Network Rail defended its practices, with a spokesperson telling Recruiter: “Network Rail complies fully with the tax law. The arrangements we have in place for contractors have been developed using the HMRC online CEST tool and are entirely compliant with the requirements of the intermediaries legislation.”

However, as Chaplin highlights, Network Rail’s confidence appears misplaced: “As we noted at the time, despite being approved by HMRC, this approach is non-compliant as it fails to assess contractors on a case-by-case basis. Now we have to ask, in addition to being subject to incorrect status assessments, are hundreds of Network Rail contractors assuming their hirer’s tax liabilities?”

How many contractors are funding employment taxes?

With the evidence suggesting unlawful practices on behalf of Network Rail, Chaplin warns that the strikingly high number of ‘inside IR35’ assessments from the likes of the Met Office and HS2 might suggest that more contractors are funding their hirer’s employment taxes:

“When we exposed Network Rail’s assessment practices, we noted the strain that this approach must be putting on the organisation due to the presumed increase to the cost of engaging each ‘inside IR35’ contractor.

“On the basis of this latest evidence, it would appear as though this cost is being offloaded to the workers themselves. This might explain why Network Rail was happy to process so many individuals as ‘inside IR35’ in the first place.”

He concludes: “Given the disproportionately high volume of contractors being deemed caught by IR35 elsewhere in the public sector, I wonder exactly how many more are being exploited in a similar manner.”