Contractors need to understand HMRC is trying to achieve the unachievable in its bid to develop an online IR35 test that provides a binary answer to determine whether or not each user is caught by the legislation.

Following the announcement of proposals to reform IR35 in the public sector, the taxman has vowed to “develop a simple and straightforward digital tool to provide employers with a real-time HMRC view on whether or not the intermediaries rules need to be applied.”

However, according to ContractorCalculator CEO Dave Chaplin - who knows all about the requirements for developing an accurate IR35 testing tool, having created his own seven years ago – HMRC is massively underestimating the complexity of the legislation.

“Are we now expected to believe that HMRC put the market through 17 years of pain because it simply didn’t have the time to build its ‘simple online tool’? Or is it rather the case that building a simple tool isn’t actually possible due to the inherent complexity?”

HMRC tool aims to achieve ‘upfront certainty’

HMRC has since pushed ahead with its plans, with a recent consultation outlining the proposed regime. Notably, the responsibility for determining a contractor’s IR35 status will rest with the public sector clients and agencies, who will also be deemed liable for outstanding tax if a contractor considered to be outside IR35 is subsequently determined by HMRC to be in.

The consensus amongst the contracting community is that shifting this responsibility over to less informed, more risk-averse clients or agencies will see more contractors deemed to be within IR35 and unfairly placed on a payroll.

In an attempt to minimise the burden imposed on engagers, HMRC’s consultation puts forward plans for a ‘simplified process’, backed up by a new online IR35 testing tool which it claims will be released in time for the implementation of the changes in April 2017. This, the consultation reads, will provide “upfront certainty” as to a contractor’s IR35 status, and a decision that HMRC will be “bound by”.

HMRC underestimates IR35 complexity

The regime has been met with strong opposition from the contracting sector, with stakeholders highlighting numerous oversights that will inhibit HMRC’s test from reaching a balanced and fully informed conclusion. For Chaplin, the sheer complexity of the legislation means absolute certainty over a contractor’s status can rarely be achieved.

“IR35 is underpinned by employment case law, which requires years of experience to fully understand. In reality, the only way to ever really know the IR35 status of a contractor is to ask an experienced status expert to look at it, and then to get it tested in a tax tribunal or in court.

“There is simply too much to consider for one to reach a conclusive judgement based on an objective questionnaire, yet this is what HMRC claims it will do within its consultation,” he adds.

“The finest legal minds in the last 17 years haven’t been able to boil down decades of employment case law into a one page IR35 questionnaire that provides a binary result. How HMRC is going to achieve this in time for April 2017 is anybody’s guess. If it was possible, it would already have been done by now.”

Subjective nature of employment status renders test futile

Chaplin notes that the added complexities of each contractors’ working arrangement means each instance needs to be considered individually. For example, it would be unfair to test an IT contractor and a construction contractor on the same basis because they operate in different regulatory environments.

“You can’t simply ask an engager to estimate the amount of control they consider to be present within a contract on a scale of one to five. An approach like that doesn’t map out in real life. Most status experts would want to delve into the detail and ascertain all of the aspects of control that were going on, which will be different for every type of job and market sector.

“But HMRC wants to decipher a definitive inside/outside ruling for each and every user of its test, regardless of the industry they work in. It can’t be done. It’s a naïve attempt to achieve the impossible.”

ContractorCalculator IR35 test places contractors on spectrum

Chaplin speaks from experience. Backed by 30 years programming experience and 17 years knowledge of employment case law, he developed ContractorCalculator’s online IR35 test. However, he has found that the subjective nature of IR35 means that, at most, a contractor can be placed on a spectrum.

“We have the most accurate IR35 tool on the market. Nobody else has managed to build an IR35 tool of equal complexity that aligns with case law. But because the answers are subjective, the outcome has to be presented on a spectrum. As a result, roughly half of users are deemed to be borderline.”

Chaplin explains that, whilst certain questions provide answers that can alone mean a contractor is either inside or outside of IR35, other questions yield answers that make it more or less likely that a contractor is caught by IR35. As a result, a contractor could find themselves borderline fail, borderline pass or right between the two.

HMRC to ‘draw a line in the sand’

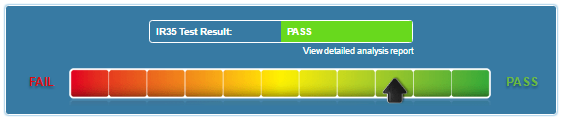

The below chart shows the spectrum that contractors will find themselves on having completed ContractorCalculator’s online IR35 test. The test uses a bespoke algorithm that incorporates case law and the relative importance of key factors such as substitution and control. Despite this, the results from thousands upon thousands of tests conducted indicate that 45% of users who take the 53 question test fall within the borderline section.

“Take the M1 from London to Leeds, for example,” he adds. “You can’t assume somebody who is not in London is in fact in Leeds. They could be closer to London, closer to Leeds, or slap bang in the middle. But this is the logic HMRC is attempting to apply.”

Given the non-conclusive results that the IR35 test can yield, it appears an impossible task to draw a line that fairly and perfectly divides those who are caught and those who are not. Yet this is what HMRC has promised to do. For Chaplin, the chances of this line being drawn straight down the middle are very slim:

“For HMRC to achieve a binary result from the tool it would have to cheat by drawing a line somewhere along the spectrum. Having spoken to personnel at HMRC who have made it clear that the taxman doesn’t like the idea of some people perhaps “getting away with it”, the likelihood is that those who are hovering anywhere between certain pass and fail will automatically be deemed within IR35.”

HMRC doesn’t possess necessary expertise

Ultimately, to develop a tool that can come remotely close to achieving HMRC’s goal requires an individual with a combination of expertise that it very likely doesn’t possess within its ranks, as Chaplin explains:

“Developing an effective IR35 tool takes a unique set of skills. You need programmers with experience designing algorithms for artificially intelligent systems. You need tax experts who understand the entire history of IR35 case law and employment case law to provide guidance on what questions need to be asked. And you need a modelling expert to ensure that the tool reaches the same conclusion that a human would.”

Whilst Chaplin doesn’t doubt that the taxman will be able to source experts in each individual field, the chances of finding somebody with all of these skills combined are extremely slim, but an essential requirement nonetheless.

For example, it is highly unlikely that a status expert will have programming or AI design knowledge to immediately determine what questions aren’t going to yield sufficiently detailed answers. In which case, the status expert will be reliant on the programmer to suggest alterations to the algorithm. However, if the programmer doesn’t understand case law, the likelihood is they aren’t going to make very good suggestions.

“This activity will go around and around in circles in analysis paralysis before anything at all meaningful comes of the whole process,” Chaplin adds.

Tool unlikely to achieve desired effect

If HMRC’s estimated IR35 tax shortfall is to be believed, its track record identifying and taxing those caught by the legislation leaves a lot to be desired. After 17 years of unsuccessfully tampering with IR35, it looks extremely unlikely that an online tool will prove to be the answer to the taxman’s prayers.

“My bet is HMRC will use scare tactics to try and force agencies and engagers to push contractors into IR35 for tax purposes, even if they aren’t actually caught,” notes Chaplin, who concedes that this might work for an initial period of time, but doesn’t expect it to be long before contractor clients and the contractors themselves grow wise and find ways around this strategy.

“Clients will discover that their contractors’ status can be checked properly, first by using our tool, and then by speaking to an expert. Even if HMRC comes out with a tool, it will be gamed,” he adds. “The market will quickly work out how to get a pass mark which is in HMRC’s words a binding decision.”

Chaplin alludes to the implementation of the right to substitution into many contracts in 1999 amongst contractors to avoid IR35, concluding: “It might have to involve actually making sure a substitution takes place, but if that’s all it takes to get rid of the burden, then it’s not so bad.”