A brand-new free CEST determination checker is set to help thousands of businesses and contractors with their IR35 status determinations.

The checker, released by IR35 compliance firm IR35 Shield has been developed to help check the details of a CEST determination and inform users of any areas of weaknesses with the CEST assessment.

HMRC's CEST tool was released in 2017 to help firms determine the status of their workers when the Off-payroll legislation was enacted. However, since its introduction, CEST has become misaligned with the law, putting businesses at risk.

Dave Chaplin, CEO of IR35 Shield, said: "CEST is not mandatory nor a panacea on status issues. Its current misalignment with the law can inadvertently present firms with tax risk.

"So, to help firms and contractors navigate status determinations better and know where they stand, we have designed a free CEST checker to help users understand how CEST reached its decision and any weaknesses in the determination."

What are the critical concerns with CEST?

The CEST checker is based on detailed exploration work of CEST by IR35 Shield. The findings are in a 34-page report titled: Check Employment Status For Tax (CEST): Exploring the reliability and accuracy of HMRC's status assessment tool.

The exploratory work conducted by IR35 Shield highlighted many concerns with CEST, including:

Despite HMRC promising Parliament to keep CEST updated, the underlying rules engine has not been updated since 24 October 2019 – since then, eighteen IR35 tribunal decisions have been published.

The IR35 tribunal decision of HMRC v Atholl House made by the Court of Appeal on 26 April 2022 proved that many of HMRC's longstanding case law status arguments, upon which CEST was built, were wrong.

CEST's single-factor approach to "Outside IR35" determinations can breach the statutory need to take reasonable care.

What does HMRC think about CEST?

HMRC and Treasury's views on CEST and its reliability are best summarised by quoting the contents of a letter they wrote to the House of Lords in March 2022:

"It is not compulsory to use CEST to reach a status determination… Clients can use other tools or other forms of tax advice...

"Regardless of whether a client has used CEST or not, HMRC's compliance checks will always examine the actual working arrangements and contractual frameworks in place for the engagement in question to reach a view on whether status has been correctly determined in line with the relevant case law."

Chaplin says: "Firms must understand that CEST is not in statute, and any investigation conducted by HMRC will rely on an examination of the facts and an application of the law."

How to use the CEST Checker

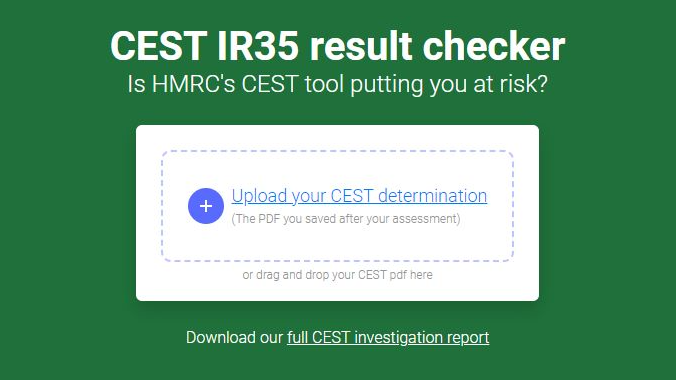

Users can use the CEST checker for free by visiting: https://www.ir35shield.co.uk/hmrc-cest-status-result-checker.

The 4-step process is simple:

- Conduct your assessment using the HMRC CEST tool.

- Download the CEST results to a PDF.

- Upload the PDF to the CEST Checker.

- Read the observations.

If you already have a CEST determination, skip steps 1 and 2 and drag and drop it onto the page, and the results will be instantly shown.

What does IR35 Shield now recommend?

The CEST Report makes some key recommendations for each stakeholder in the supply chain:

Given the level of tax risk exposed by CEST's "single-factor" approach, firms should be wary of relying on "Outside IR35" CEST outcomes and ensure that they consider all relevant factors and conduct multi-factorial determinations.

Where firms are unsure of the underlying status case law, they should take advice from specialist IR35 defence experts with HMRC enquiry and tribunal experience.

Contractors who have been given "Outside IR35" determinations from hirers should be careful not to sign onerous clauses in contracts which indemnify their clients should HMRC disagree with the result.

Contractors still operating under the "small companies exemption" who conduct their assessments and take on the tax risk should seek a second opinion from an IR35 specialist and use a tool which fulfils reasonable care by considering all factors.

All businesses should have a Tax Investigation Service so that if HMRC does investigate, they are professionally represented (with costs covered) by specialist IR35 defence experts with HMRC enquiry and tribunal experience.

As for CEST, the report recommends it may be prudent for the CEST disclaimer to be updated to be more transparent about the level of certainty it offers.