HMRC has been condemned for abusing its powers after evidence has come to light that the taxman has been sending misleading letters to contractors in an attempt to increase the Off-Payroll legislation’s tax yield.

The letter, sent to a contractor by HMRC, identifies the individual as someone who had worked in the public sector via a limited company during the 2017/18 tax year. It then requests that they clarify their IR35 status using the flawed Check Employment Status for Tax (CEST) tool and contact the taxman should CEST determine them to be ‘employed’.

Notably, the letter also threatens the contractor with a penalty in the event that HMRC conducts a compliance check and finds inconsistencies, despite the fact that public sector bodies and agencies are responsible for compliance with the Off-Payroll rules.

“This is clear coercion and a blatant abuse of powers by HMRC. Contractors have no legal obligation to respond to such letters, or use HMRC’s defective tool to assess status, yet the language indicates that they do,” comments ContractorCalculator CEO, Dave Chaplin. “If contractors receive letters like this, they should ignore them.”

HMRC Off-Payroll correspondence ‘preying on contractors’

The letter, which is entitled: ‘About using a Personal Service Company (PSC) in the public sector – you need to check your employment status’, begins by explaining the compliance requirements of the Off-Payroll rules, before adding:

‘Please check to see if your employment status is right or was right when you used a PSC. You can use our online tool called CEST to do this… You should carry out this check within the next 30 days. We’ll contact you again to find out what action you’ve taken.’

For Philip Manley, former HMRC inspector and current tax partner at Dow Schofield Watts, the taxman appears to be preying on the credulity of contractors who aren’t entirely familiar with Off-Payroll:

“The first thing to point out is that, contrary to the letter, the contractor doesn’t need to check their employment status. This is even acknowledged by HMRC where it clarifies that the compliance responsibility lands with the public sector body and possibly the agency.

“Secondly, use of CEST is not mandatory. Predictably, the letter doesn’t clarify this and, in fact, implies otherwise. Outside of tax and accountancy professionals, I imagine very few would be aware of this, and so it’s likely that many recipients of this letter have been falsely led to believe that a CEST assessment needs doing.”

He adds: “This is made even worse by the fact that CEST has demonstrated alarming inaccuracies, which have already been proven by work conducted by ContractorCalculator and in the courts.”

HMRC asks contractors to conduct own compliance checks

Should the contractor find that CEST evaluates them as ‘employed’, the letter requests that they provide the taxman with certain information. This includes:

- The name of the hiring organisation or agency, and their employment status decision

- The contract length and payment terms

- Total amount of any repayments received.

“HMRC has publicly acknowledged that CEST is not legally binding and is just a guidance tool,” notes Chaplin. “So why is it insisting that contractors use its tool to determine whether they should hand over the necessary details for HMRC to calculate a new, increased tax bill? If this is how HMRC is responding to these disclosures, then it’s another case of the taxman acting ultra vires.”

“The most audacious aspect of this all is that HMRC is essentially asking contractors to enquire into themselves,” adds Manley. “This is the job of HMRC staff, who I know from my background are paid sufficiently to do so.

“Much like the way in which the Off-Payroll rules passed the buck onto hirers and agencies, HMRC is now trying to offload its responsibilities onto the contractors themselves. The whole gist of the letter is: ‘use this tool and share your contract details or else we will actually have to do our own job’.”

Penalty threat typifies taxman’s aggressive approach

The letter has surfaced just a month after the publication of a House of Lords report which criticised HMRC for its “increasingly aggressive behaviour towards taxpayers”. This approach was once again typified within the taxman’s correspondence, which states: ‘Please note, if we carry out a compliance check and find something wrong, you may have to pay a penalty.’

For Manley, the mention of penalties at a stage where an enquiry hasn’t been opened is unnecessary fearmongering: “In reality, a penalty can only be applied if found warranted following an enquiry. In the context of this letter, you would be led to believe that failure to respond to HMRC as requested could result in a penalty.

“I can only think of one reason why penalties are even being mentioned in a speculative letter such as this, and that’s to instil fear,” he adds. “HMRC knows that the recipient is under no obligation to respond, so it’s employing underhand tactics to achieve its desired end.”

Contractors encouraged to ignore HMRC Off-Payroll ‘propaganda’

Indications suggest that this is a fishing letter from HMRC, which many more contractors have or can expect to receive in the near future. The individual in question has confirmed that he didn’t work in the public sector during the specified timeframe, despite HMRC claiming that he did.

Moreover, the letter offered advice on submitting a self-assessment tax return for 2017/18. The recipient had submitted his months before receiving the letter, suggesting that HMRC hadn’t even looked into his records before issuing the letter.

Regardless of the circumstances of future recipients, the message from Manley is clear: “The individual has met their obligations by submitting a return which they believe to be correct.

“My advice to anybody who receives this propaganda is to remember that there is no danger whatsoever in choosing to ignore it. There is no legal requirement to respond as it would entail performing HMRC’s own duties.” Manley concludes: “If you choose to respond, there is a higher than average chance that CEST will tell HMRC what it wants to hear – which will by no means be your correct IR35 status.”

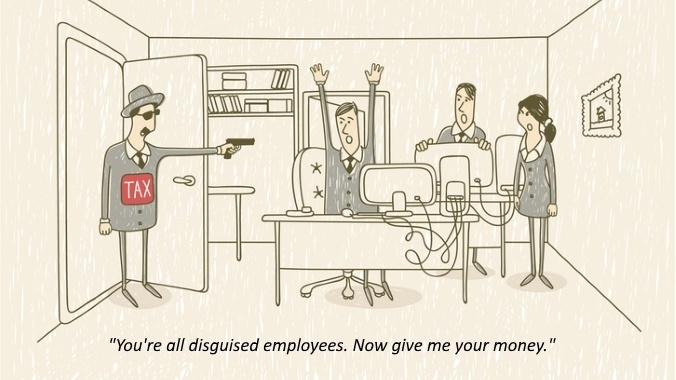

Chaplin agrees: "CEST has been shown to give inaccurate and heavily biased results. For example, at the BBC it indicated that 97% of it's self-employed presenters should be treated as inside IR35 - a preposterous notion. CEST is essentially a confidence trick by a Government body that is trying to override the laws to collect the maximum amount of tax it can, and not the correct amount of tax. HMRC are using CEST like a modern day digital version of highwayman Dick Turpin."

To view a copy of the letter click here.