In its representation for the Autumn budget, PRISM, the trade body for umbrella companies, called on the Government to stop and analyse all evidence, before making plans to extend IR35 rules to the private sector.

IR35 regulation has created considerable issues to contractors and free-lancers working for the public sector. Since the introduction of the new rules into the public sector in April 2017, there have been fears among contractors, recruiters and organisations working with self-employed that the Government plans to eventually extend the IR35 regulations to the private sector.

Crawford Temple, CEO of PRISM, said, “The IR35 legislation, as it stands, contains incentives and protections for both recruiters and workers to seek out providers who offer high-return but non-compliant solutions. Since its introduction we have seen an increase in non-compliant offerings, with many able to fold when approached by HMRC.

The regulation in its current form means it is highly unlikely that HMRC will be able to collect any taxes due from the non-compliant providers and therefore the anticipated tax gains will be significantly reduced.

Extending these rules to the Private Sector will exacerbate the problem and will not deliver the expected HMRC returns. The long-term answer is a structural reform of the tax system, rather than a sticking plaster approach of tweaking rules.”

Back in May, PRISM uncovered several instances where HMRC were giving contactors incorrect advice about their tax status and IR35 implementation, highlighting how complex the rules are.

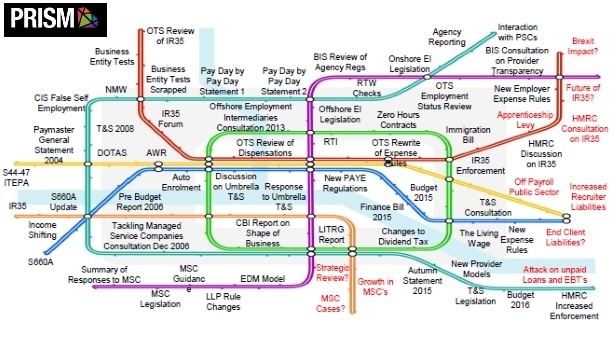

For the past three years PRISM has been advocating for structural reform of the tax system as the only solution to regulations that are too complex, very costly to enforce and that unintentionally encourage non-compliance.

PRISM’s work resulted in two reports (accessible here and here) outlining tax reforms for contractors which would also help tackling the fake self-employment phenomenon in the “gig economy”, an issue that is dominating the Government and press agenda.

In early September, PRISM hosted an event in Parliament, attended by ContractorCalculator CEO Dave Chapolin, where Crawford Temple called on politicians, unions and sector organisations to come together to find solutions to fix the gig economy.

Dave Chaplin, CEO of ContractorCalculator, welcomes this stance by PRISM: "We've had enough reviews now - everything that needs to be said has been said, and it is now time for politcians to be brave and make sweeping changes to the tax system to bring it in line with the modern way of working. No more sticking plasters."