Former BBC presenter, Christa Ackroyd, lost her appeal against HMRC recently in the first IR35 tax tribunal in seven years, subjecting her to a tax bill of over £400,000.

The judge ruled that Ackroyd had unanimously failed each of the three key tests of employment, in addition to there being strong indications that she was economically dependent on her contract with the BBC. The judge concluded IR35 did apply.

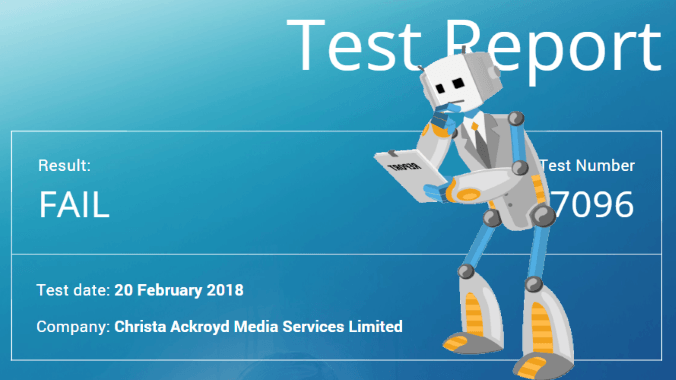

The same conclusion was reached when we ran the details of Ackroyd’s engagement through Renoir: IR35 Shield’s AI-powered virtual employment status lawyer. Renoir therefore maintains it’s 100% accuracy in determining correctly the IR35 status of defendants and appellants in all 22 of the IR35 cases that to have gone to tribunal.

More importantly for contractors, enlisting Renoir’s services for free before agreeing a contract can help ensure that they never encounter the same huge sums in back taxes that Ackroyd now faces.

Ackroyd IR35 case: how important was control?

Ackroyd’s appeal failed largely as a result of strong indications of control. Renoir’s findings were consistent with this, and particularly identified strong elements of control regarding how and what Ackroyd was asked to do at work.

Although Ackroyd could demonstrate a certain degree of autonomy over how she carried out her work, this was far outweighed by the ultimate editorial control held by the BBC. This control was demonstrated within its Editorial Guidelines, which Ackroyd was bound by, although not specified explicitly within her contract.

Critically, the BBC reserved the right to stipulate which services Ackroyd provided in her presenting role at Look North, which both the tribunal judge and Renoir deemed sufficient to fulfil the ‘what’ criteria.

Renoir on MOO and personal service

Although Ackroyd’s engagement produced favourable answers to several questions on mutuality of obligation (MOO), Renoir still issued a strong fail in this category. This was largely due to several incriminating features of Ackroyd’s contract:

- The contract itself was fixed-term and lasted seven years

- It cited a minimum of 225 days per year where the BBC retained ’first call’ on Ackroyd’s services

- It required the BBC to pay fees to Ackroyd’s company regardless of whether her services were called upon.

Renoir’s report also highlighted the issues created by Ackroyd being contractually obliged to undertake unscheduled assignments in certain circumstances, such as reporting on breaking news stories.

Ackroyd failed the personal service test as she was unable to provide a substitute. However, this case was considered an anomaly, with personal service dismissed as a minor factor by the judge due to the fact that Ackroyd was providing her services as a presenter, as opposed to a commercial service provided by a typical contractor.

Don’t leave it to tribunal – test your IR35 status for free today

Renoir concludes that Ackroyd would have required considerable professional intervention from the outset to rectify several elements of her contract to even stand a chance of passing IR35.

The necessary legal expertise is on hand via third parties as part of IR35 Shield’s assessment solution. The fees for which pale in comparison to the sums in back taxes which can evidently be incurred otherwise.

As the Ackroyd case demonstrates, the best course of action is to prevent any risk from the outset. The first step in doing so is to assess the IR35 status of your contract for free with Renoir.