New information has emerged that should concern any business engaging contractors and dealing with IR35 compliance. A Freedom of Information (FOI) request to HMRC has exposed that the underlying decision engine of HMRC's Check Employment Status for Tax (CEST) tool – relied upon by countless firms to assess IR35 status – has not been updated in five years. This is despite explicit promises made to Parliament by the Head of HMRC that the tool would be continually revised to align with evolving case law.

The stagnation of CEST means that businesses using it to determine the IR35 status of contractors are making decisions based on outdated logic that no longer reflects the current legal landscape. Shockingly, CEST has remained frozen since 2019, even as more than 20 IR35 tax tribunal hearings have taken place, including the landmark Atholl House Court of Appeal decision that dismantled HMRC's approach to IR35 status determinations. The FOI response provides irrefutable evidence, with independent sources, proving CEST's decision engine has been collecting dust for half a decade.

Any organisation relying on CEST to assess IR35 status is at risk of making inaccurate determinations that fail to align with binding case law. Continuing to use an outdated tool, based on the now-obsolete HMRC Policy View of status case law that the Court of Appeal dismissed in the Atholl House case in April 2022, could lead to significant tax liabilities, penalties, and reputational damage down the line. It is imperative that businesses urgently re-evaluate their IR35 compliance processes in light of this disturbing finding.

CEST Freedom of Information Request

The FOI to HMRC was responded to by HMRC on 04 March 2024 and confirmed the following:

- HMRC confirmed that the locations of the programming source code (available in the public domain) provided to them were correct. These are the CEST decision engine at https://github.com/hmrc/cest-decision and the CEST front-end at https://github.com/hmrc/cest-frontend.

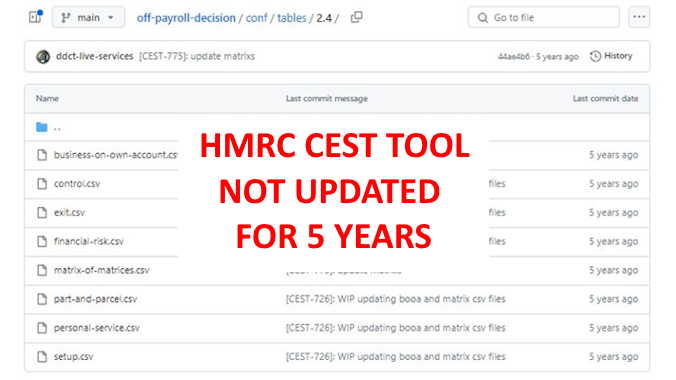

- The CEST decision engine logic is contained in CSV files, which sit in this location: https://github.com/hmrc/cest-decision/tree/main/docs and the latest publication of the decision logic can be found at https://github.com/hmrc/off-payroll-decision/tree/main/conf/tables/2.4.

- HMRC confirmed that "The logic has not changed from the data already held in the public domain, nor has the logic changed since CEST moved to its new guidance platform. As and when we make updates to the logic, those changes will be communicated publicly."

A simple browse of the latest decision logic in the public domain to which HMRC refers shows that it has not been updated for five years.

The lack of updates to CEST in five years contradicts the promise made by Jim Harra, Head of HMRC, on 04 March 2019, to the Public Accounts Committee, when he told them: "We continually update the tool as new tribunal and court decisions are made about employment status, as well as continually increasing its scope so that it can respond to more and more types of cases... It is an ongoing, unending process."

Since the last published update to the CEST decision logic, there have been 20 IR35 tax tribunal hearing decisions, including the pivotal Atholl House Court of Appeal decision, but the CEST logic has remained unchanged.

Critical problems with CEST

A 34-page report published by IR35 Shield, titled "Exploring the reliability and accuracy of HMRC's status assessment tool", was based on a forensic analysis of the CEST source code and includes references to Parliamentary evidence provided by HMRC. The report highlighted the critical issues:

- Accuracy unproven: The accuracy of CEST (Check Employment Status for Tax) has not been conclusively proven.

- No legal alignment: CEST is no longer up-to-date and may not align with current laws and regulations.

- No reasonable care: Relying solely on CEST assessments could potentially breach reasonable care.

- Not legally binding: CEST does not have legal authority.

- Not mandatory: Firms are not legally required to use CEST.

In response to questions by the Public Accounts Committee on 04 March 2019 concerning the reliability of the testing of CEST, HMRC followed up with a note to the Committee which said: "We have not retained the scripts or other material from testing, including workshop attendee lists as this was not a project requirement."

In April 2020, the House of Lords, Economic Affairs Committee Finance Bill Sub-Committee said: "We question whether the CEST tool as currently constituted is fit for purpose."

Firms are also reminded of the advice given by the Financial Secretary to the Treasury on 09 March 2022: "Regardless of whether a client has used CEST or not, HMRC's compliance checks will always examine the actual working arrangements and contractual frameworks in place for the engagement in question to reach a view on whether status has been correctly determined in line with the relevant case law."

Why CEST does not align with the law

The IR35 Shield report quotes directly from the tool's programming source code and compares it to the binding law from the court of appeal, objectively exposing CEST's flawed decision logic.

The report shows that the fundamental issue with CEST is that when it decides "Outside IR35," it has done so using a single-factor approach and disregards all factors, contrary to established case law, which requires a multi-factorial assessment that considers all relevant factors.

The underlying decision logic tables and the programming code show that CEST will form an opinion of "Outside IR35" purely by looking at either substitution or control.

The single-factor approach adopted by CEST is wrong and contradicts the seminal case of Ready Mixed Concrete in 1968. The correct approach was elucidated by Elias LJ in the Court of Appeal case in Quashie [8]: 'This approach recognises, therefore, that the issue is not simply one of control and that the nature of the contractual provisions may be inconsistent with the contract being a contract of service. When applying this test, the court or tribunal is required to examine and assess all the relevant factors which make up the employment relationship in order to determine the nature of the contract."

Does CEST create risk for users?

The single-factor approach is wrong and fails on HMRC's view of the reasonable care tests set out in ESM10014. A single-factor assessment does not consider all the relevant evidence. HMRC gave government bodies that used CEST tax bills and penalties. It's written in the published accounts.

Firms using CEST should consider studying the unequivocal independent evidence in the public domain that now demonstrates that "Outside IR35" assessments produced by CEST provide little or no protection and instead create risk rather than reduce it.